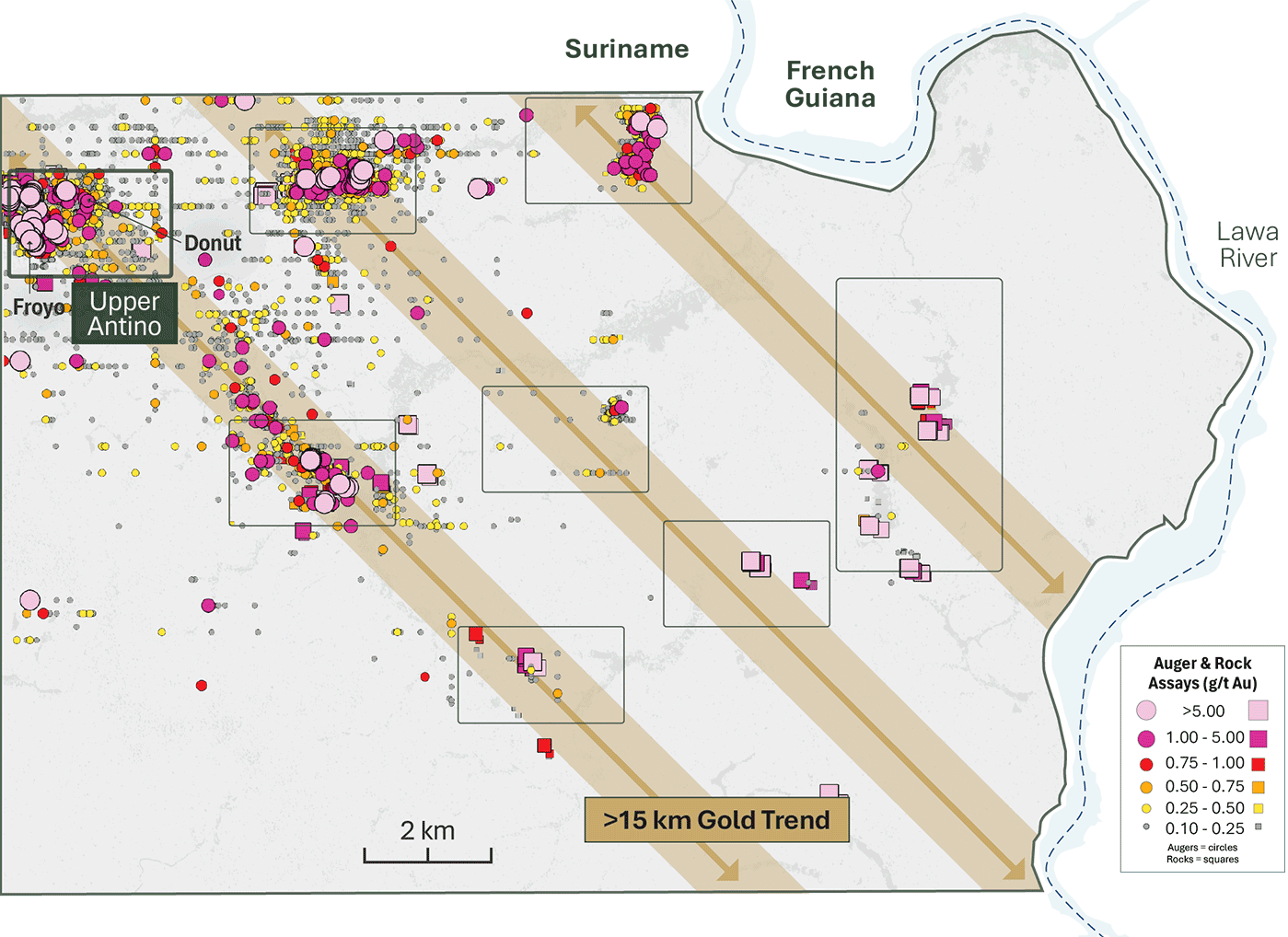

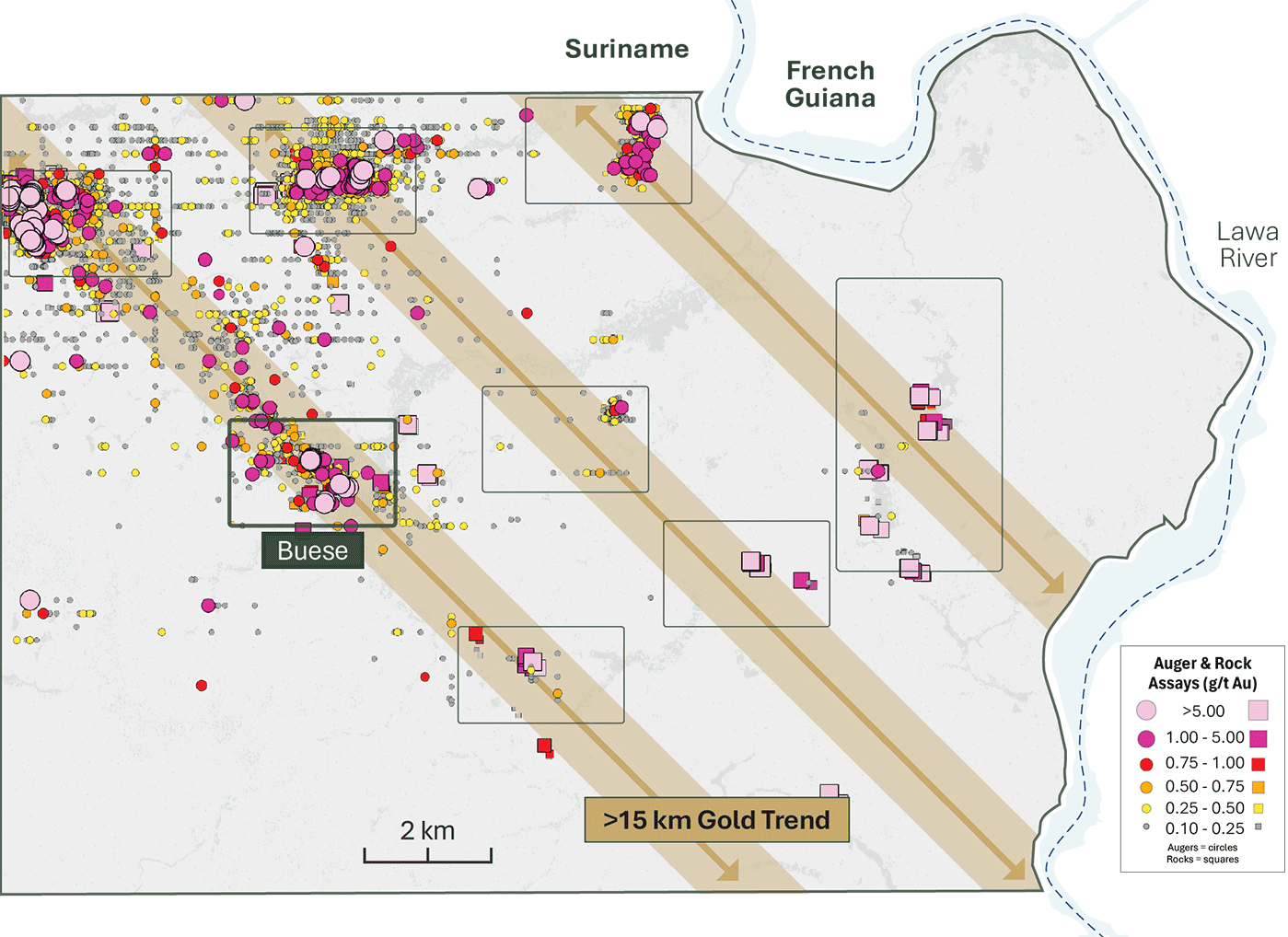

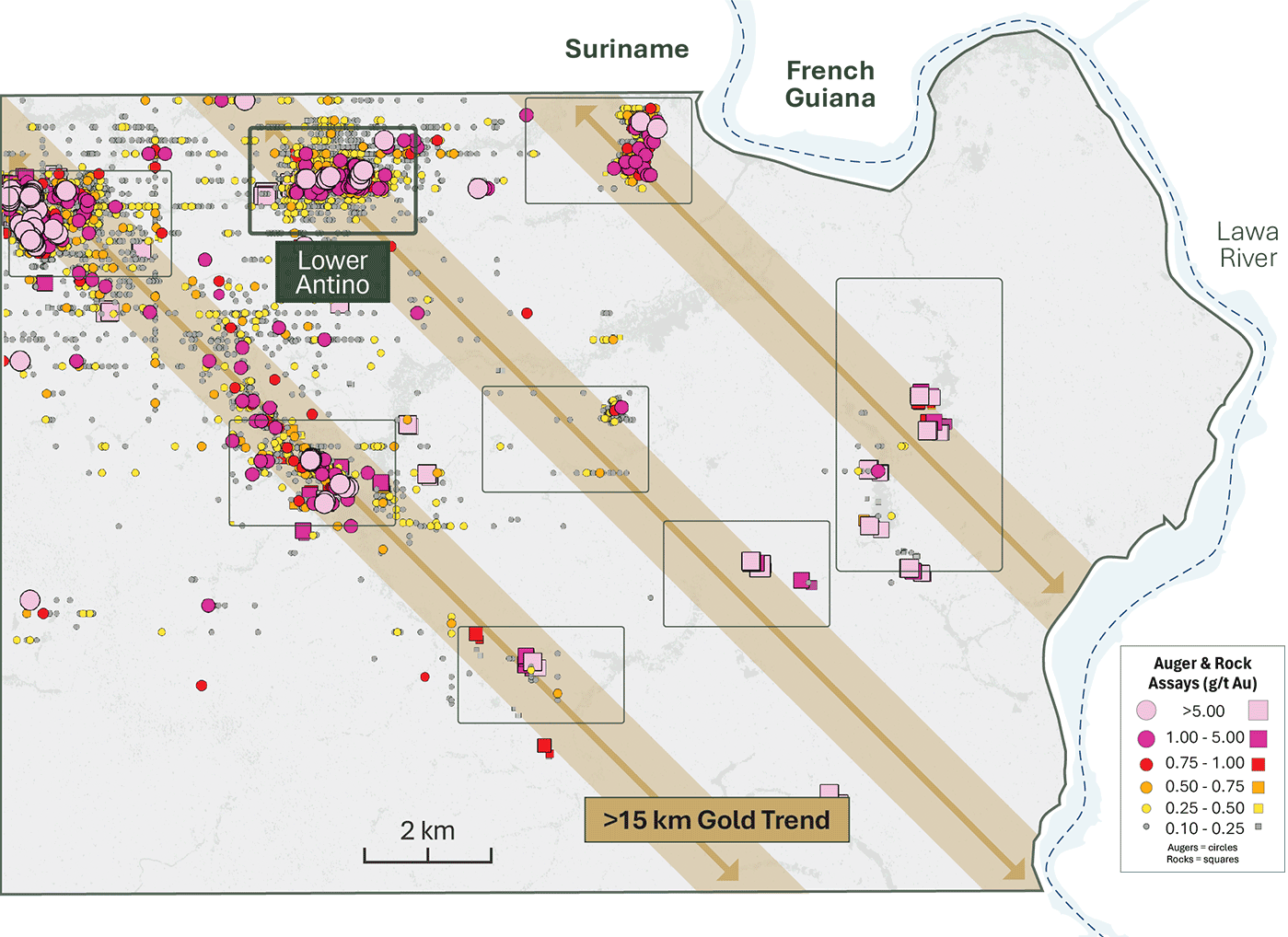

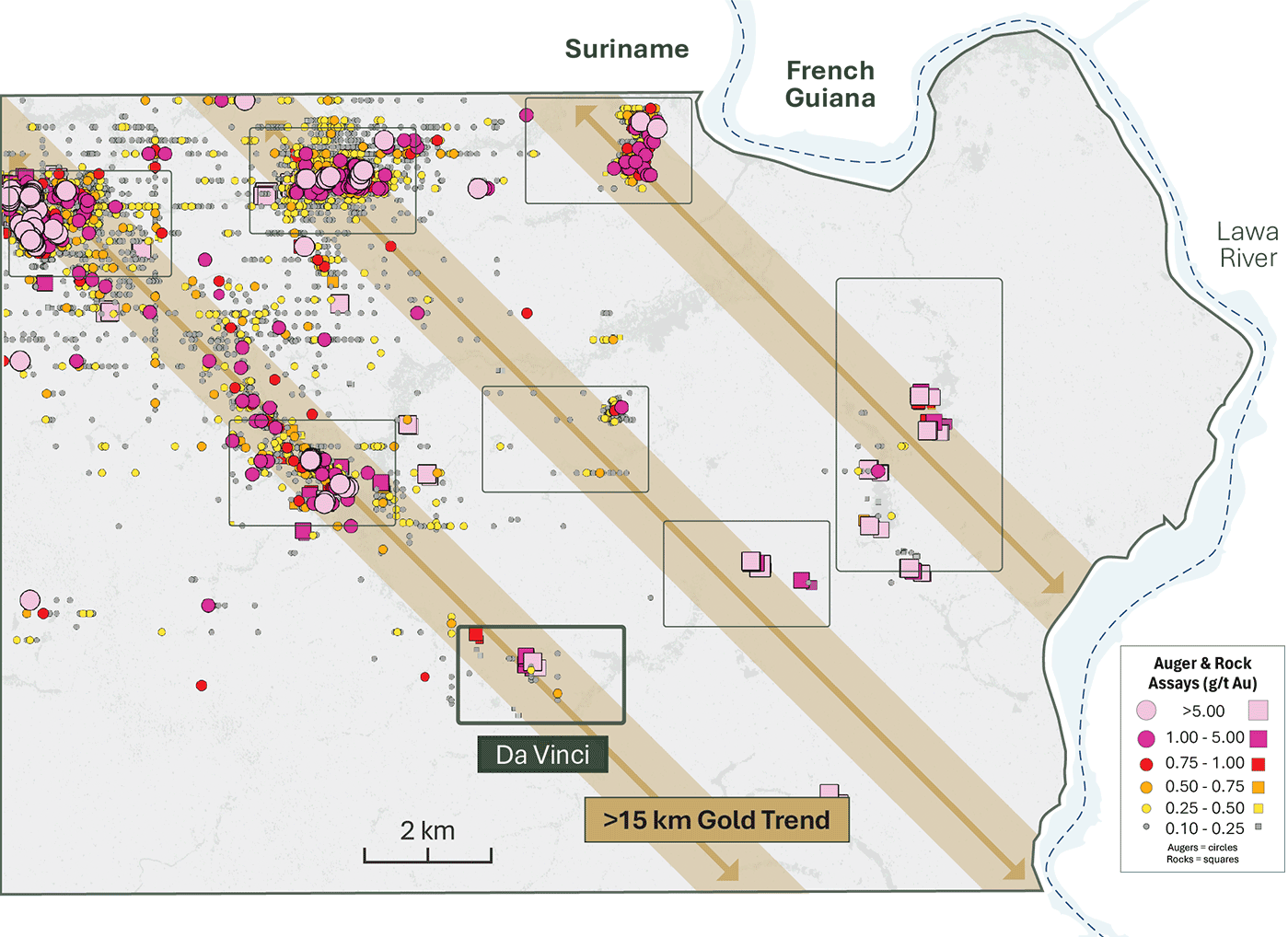

The Antino Gold Project

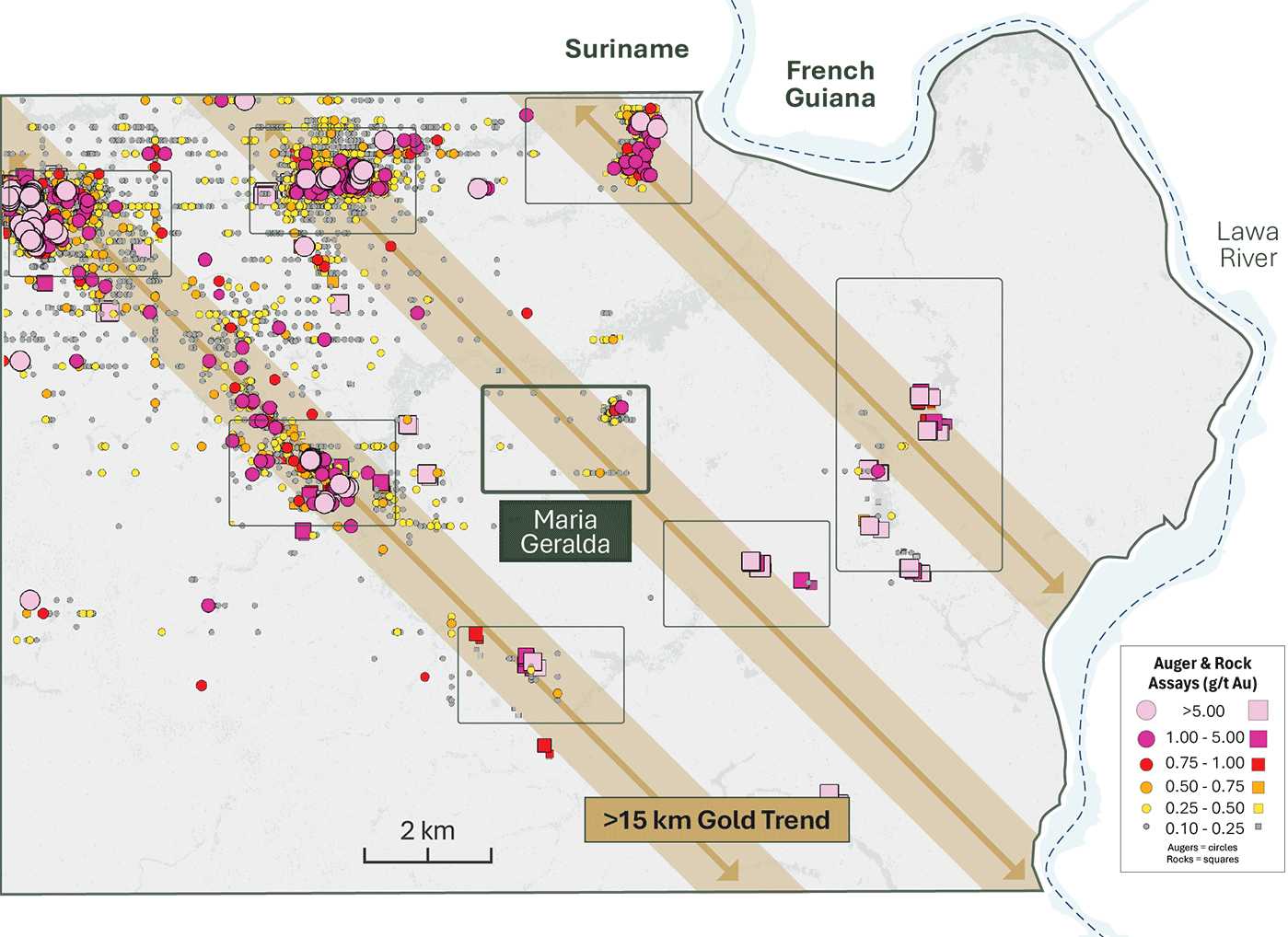

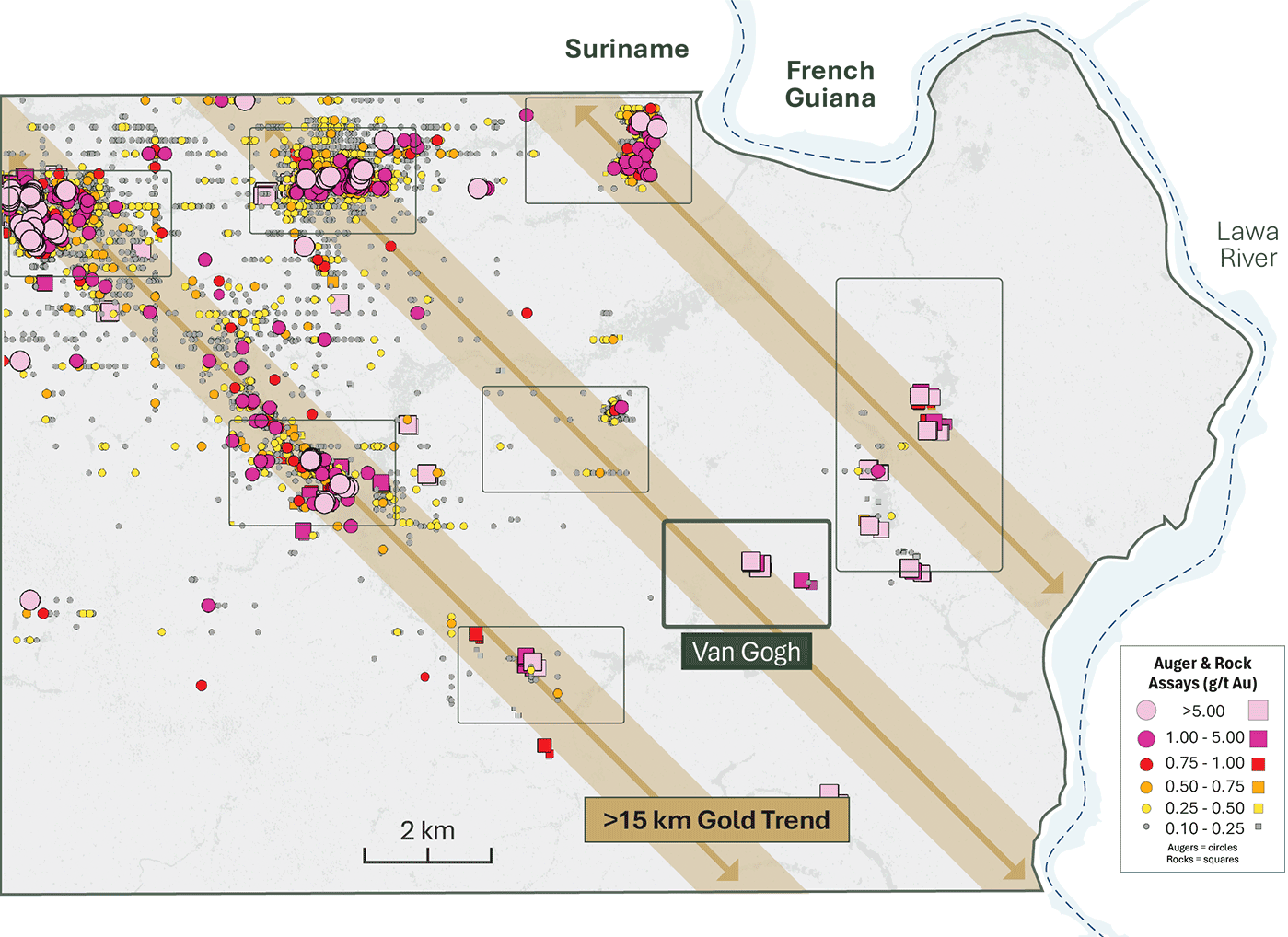

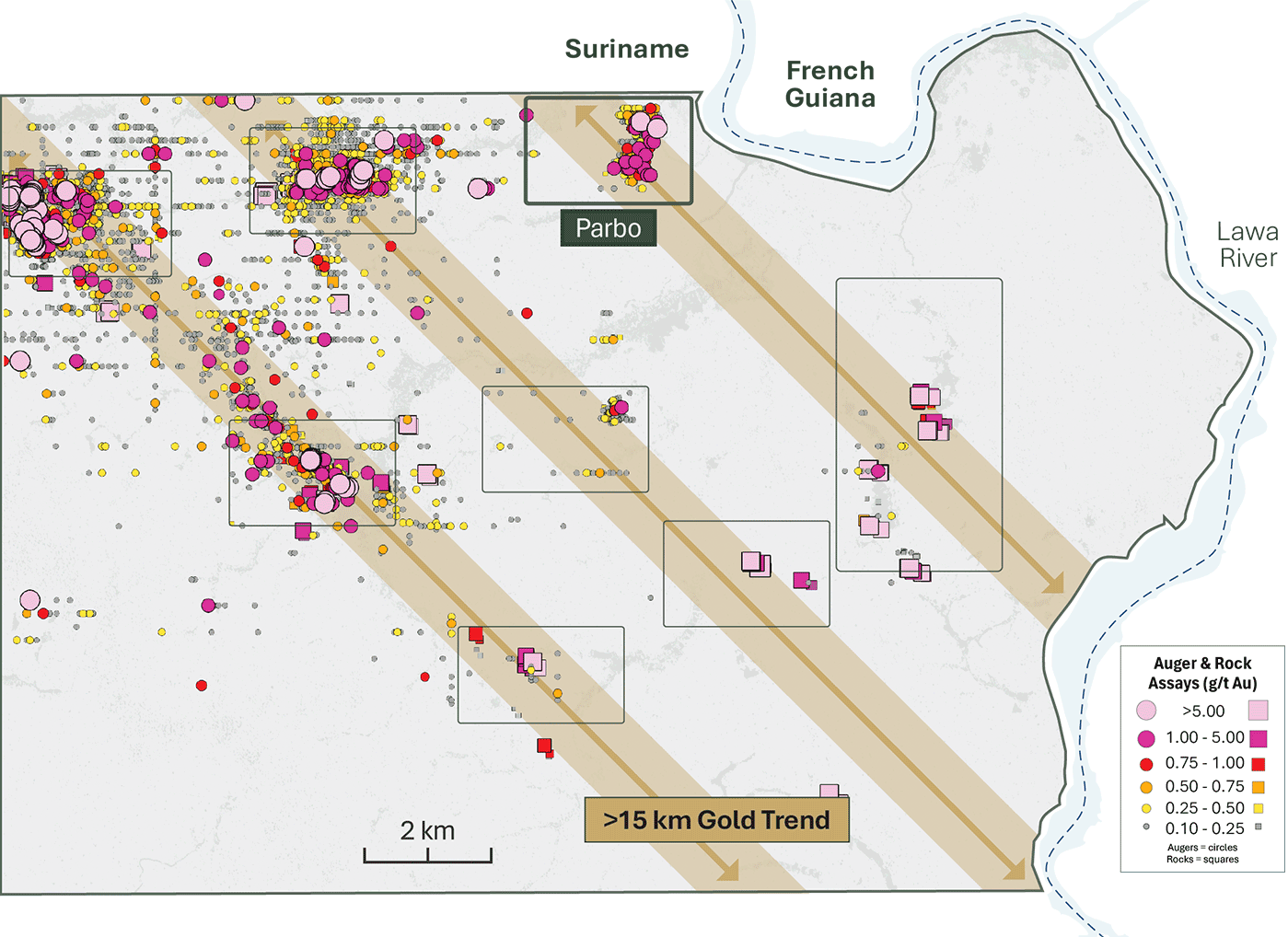

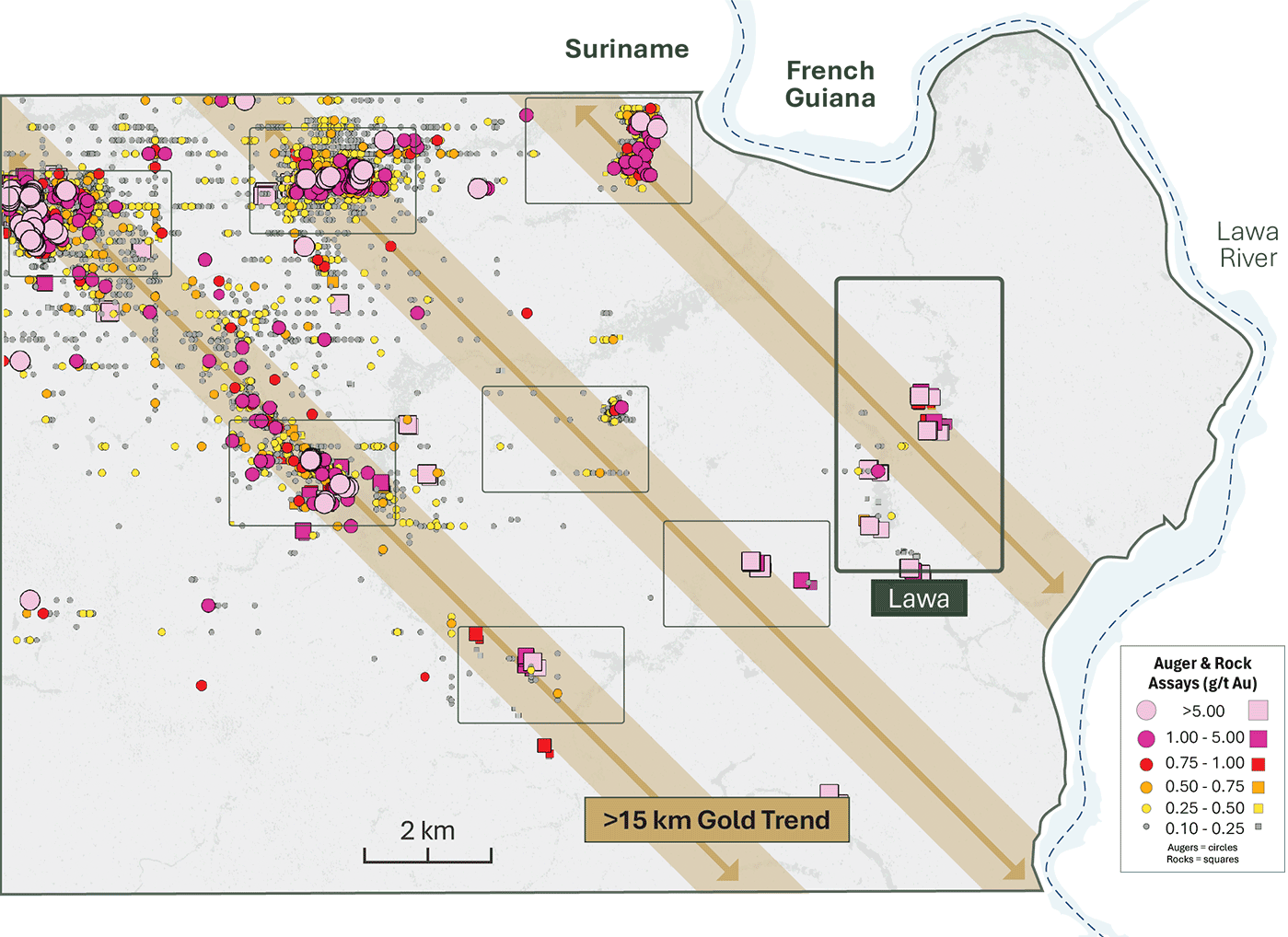

The Antino Gold Project is Founders Metals’ flagship asset – a district-scale exploration Project located in southeastern Suriname, within the heart of the Guiana Shield, a region of highly prospective geology for gold mineralization analogous to West Africa’s established gold districts.

Covering 56,000 hectares, Antino has a rich history of artisanal gold production with over 500,000 ounces1 historically produced on the project. Today, Founders is unlocking the project’s untapped potential through a modern, systematic exploration strategy designed to expand known mineralized zones and discover new targets across the Antino Project

1 Technical Report Antino Project Suriname, South America